New Pension Rules 2024

New Pension Rules 2024. This follows tpr’s consultation in. You will be able to drawdown your pension at any age between 66 and 70 using.

The uk government has published for consultation draft legislation on the new pensions tax regime, intended to be effective from 6 april 2024. Hmrc’s march lifetime allowance newsletter confirms that, where individuals have crystallised pension benefits prior to 6 april 2024, their available overseas transfer allowance from this date will be reduced by an amount equal to 100% of the value of.

Comprehensive Guide To The Uk's 2024 Pension Changes.

Transitional rate below full rate:

What's New For January 1, 2024?

Sat 2 mar 2024 06.00 est.

You Will Be Able To Drawdown Your Pension At Any Age Between 66 And 70 Using.

Images References :

Source: www.riverside-consultants.com

Source: www.riverside-consultants.com

How To Benefit From The New Pension Rules Riverside Financial Consultants, Comprehensive guide to the uk's 2024 pension changes. On 14 march 2024, the government made several of these further technical legislative changes through the pensions (abolition of lifetime allowance charge etc).

Source: www.youtube.com

Source: www.youtube.com

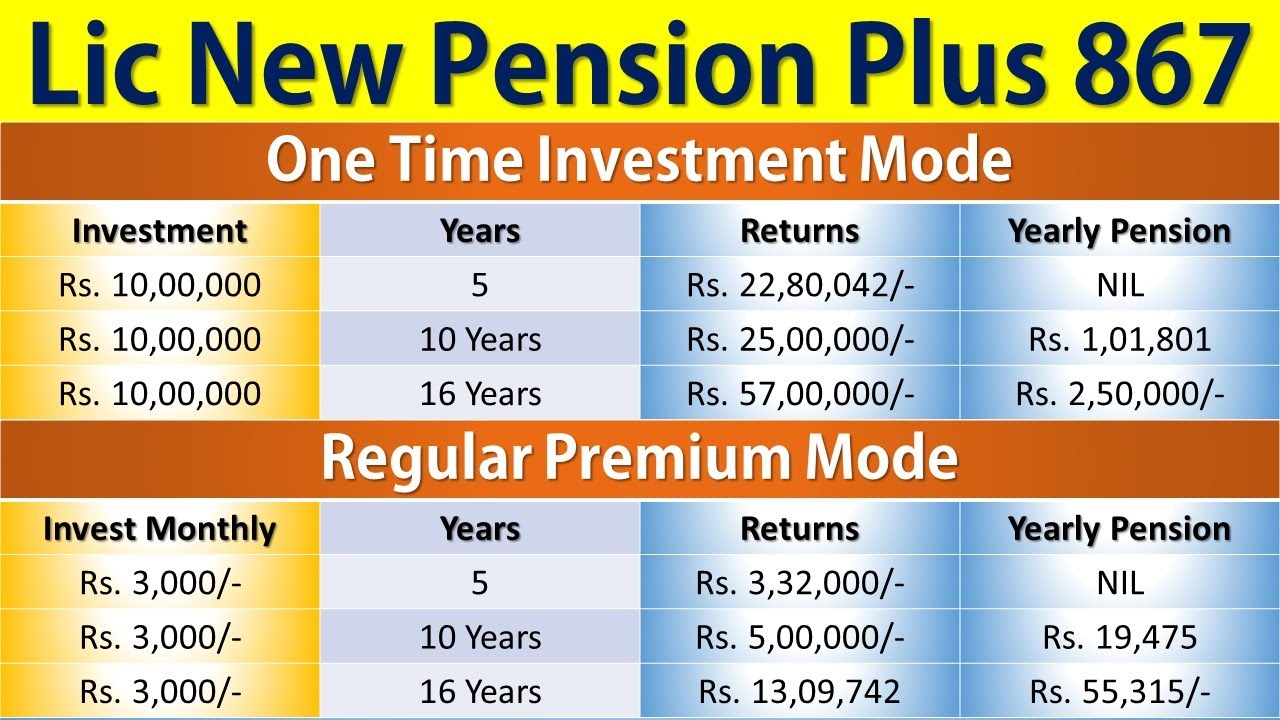

Lic New Pension Plan 867 Lic Pension Plan 2022 Lic New Pension Plus Plan नई पेंशन प्लस, Normally, if you tap your 401(k) before age 59 1/2, you must not only pay taxes on that money but also pay a 10% early withdrawal penalty. Learn about the new pension allowances, lump sum and death benefits, and tax planning strategies to optimize your.

Source: www.gobankingrates.com

Source: www.gobankingrates.com

What Is a Pension Plan and How Does It Work? GOBankingRates, Transitional rate below full rate: On 14 march 2024, the government made several of these further technical legislative changes through the pensions (abolition of lifetime allowance charge etc).

Source: www.slideshare.net

Source: www.slideshare.net

New Pension Rules, The uk government has published for consultation draft legislation on the new pensions tax regime, intended to be effective from 6 april 2024. This follows tpr’s consultation in.

Source: ten-pac.com

Source: ten-pac.com

Retirement Savings Plans for Expats Smash your Goals!, Comprehensive guide to the uk's 2024 pension changes. The boots scheme closed to new members in 2010.

Source: socialk.com

Source: socialk.com

Annual Retirement Plan Contribution Limits For 2023 Social(K), Changes to pension fund laws allowing withdrawals are now official participate in parliament » news for the first time, from 1 september 2024,. Normally, if you tap your 401(k) before age 59 1/2, you must not only pay taxes on that money but also pay a 10% early withdrawal penalty.

Source: www.rojgargyaan.com

Source: www.rojgargyaan.com

Old Pension Scheme 2024 कर्मचारियों को बड़ा तोहफा, अब मिलेगा पुरानी पेंशन का लाभ New Pension, Normally, if you tap your 401(k) before age 59 1/2, you must not only pay taxes on that money but also pay a 10% early withdrawal penalty. Pension scheme newsletter 157 confirmed that the government would bring forward legislation to provide that individuals with enhanced protection can transfer their.

Source: obtfinancialgroup.com.au

Source: obtfinancialgroup.com.au

Changes to age pension rules OBT Financial Group, This note reflects the law in force and hmrc guidance as at 22 march 2024. These are the lump sum allowance, the lump sum and death benefit.

Source: currentaffairs.adda247.com

Source: currentaffairs.adda247.com

New pension scheme vs old pension scheme, Find out which is better?, What's new for january 1, 2024? Normally, if you tap your 401(k) before age 59 1/2, you must not only pay taxes on that money but also pay a 10% early withdrawal penalty.

Source: graydon.law

Source: graydon.law

New Rule Would Allow ESG Considerations for Retirement Plans Graydon Law, The secure 2.0 act is a recently enacted significant piece of legislation that has brought about substantial changes to the retirement account rules. Sat 2 mar 2024 06.00 est.

These Are The Lump Sum Allowance, The Lump Sum And Death Benefit.

The boots pension support group, an action group, reckons that there are roughly 23,000.

Hmrc’s March Lifetime Allowance Newsletter Confirms That, Where Individuals Have Crystallised Pension Benefits Prior To 6 April 2024, Their Available Overseas Transfer Allowance From This Date Will Be Reduced By An Amount Equal To 100% Of The Value Of.

You will be able to drawdown your pension at any age between 66 and 70 using.